Sandesh (NSE: SANDESH)

(Disc: Invested. This is not a recommendation.)

Portfolio Activity

Before I get to the stock analysis, recent portfolio activity. I sold Oracle Financial Services Software at 3934/share today, booking a 38.7% return (including dividends) on the investment for the model portfolio. While the stock has performed well, I don’t see much upside from these levels to warrant holding the stock and with the model portfolio (and my own portfolio) fully invested, I needed to exit a stock to make this new investment.

I had initially set out to sell Kaveri Seed but recent price trends make me hold onto it a bit longer. In my original writeup on the stock, I had expected a comfortable 20% return, and it currently sits 40% above the original purchase price. The stock has historically peaked around these levels before beginning a downtrend, and has exceeded the 700 levels only twice in recent history. I’ve placed a stop loss order of 620 on the stock which, if triggered, will free up enough cash for the next two investment in the model portfolio.

A quick word on the model portfolio. Since starting on July 01 2022, there have been 12 total investments made (excluding Sandesh), and 3 exits. Of these 12 stocks I’ve written about:

2 are currently at or over a 100% since writing about them (Daawat 78.15 to 160.2 and Zensartech 221.65 to 480). I sold Daawat at prices well below what it currently trades at.

8 of the remaining 10 stocks have generated positive returns, with 6 in the range of 10-80%. Everest Kanto and Ambika Cotton (the most recent investment) still bounce along their entry price (including dividends, Ambika is up 6%).

1 stock, Kiri Industries is down around 6% but my thesis rests on it either becoming a multi-bagger (by receiving the 5000cr windfall) or a poor performer, but with minimal downside.

1 stock, Jindal Poly Films, is down around 25% and is the worst performing stock in the portfolio. Seeing the recent quarter numbers of packaging stock Huhtakami, I’m hoping for similar performance in Jindalpoly. If that doesn’t transpire, I’ll be selling the stock and booking the loss.

For the first 15 months, the model portfolio has returned 31.1% including dividends against the Nifty TRI return of 23.93% (CAGR 21.55% vs 16.57%).

Onto Sandesh.

The Company

Sandesh is a stable and predictable business. Founded in 1923 and operating from Gujarat, the company's operations span print, television, digital and Out-of-Home (OOH) advertising. Over the past century, it has solidified its position as a trusted source of news and information in the state.

The core of Sandesh's operations remains its newspaper publications. Spanning 6 editions emanating from strategic locations across Gujarat, the company ensures comprehensive coverage of both urban and rural stories. Its publications are read by a large and loyal reader base, helping solidify its position as the second most read daily in Gujarat.

In addition to print, the company also operates a 24x7 Gujarati news channel, ‘Sandesh News’, and an OOH advertising division, ‘Spotlight’. The news channel is the fastest growing 24x7 Gujarati News channel, and its OOH division has secured various prestigious tenders from statutory authorities in Gujarat.

In recent years, acknowledging the global trend towards digital consumption, Sandesh has been focusing on enhancing its digital footprint. Their website not only offers an e-newspaper that mirrors its physical counterpart, but also provides real-time updates for those that prefer news on-the-go.

The Industry

While the global media industry has seen a significant decline in traditional media and a shift towards digital, India’s print (newspaper) sector continues to thrive and grow. This is largely due to the fact that India is one of the few countries where newspapers are still delivered daily to doorsteps, a practice that has cemented the role of print in the cultural fabric of the nation. Other catalysts for the sector’s continued growth include the rise in literacy rates and the continued preference in many parts of the country for tangible news sources over digital ones.

Even within the print sector, there is a clear distinction between National and English newspapers, and Regional Newspapers. Though National Newspapers boast a broader reach, Regional Newspapers (especially in languages like Gujarati, Marathi, Bengali and Telugu) command a loyal readership that often surpasses their National counterparts. For many, regional print journalism offers a credibility that is often unmatched, leading to a fiercely loyal readership base. This regional emphasis is particularly pronounced in states like Gujarat, where publications like Sandesh have become household names.

Like most other industries, the COVID-19 pandemics impact was greatly felt in Media, especially in the print sector. Both circulation levels and advertising revenues dropped dramatically at the onset, but have since gradually risen, and are now nearing their pre-pandemic levels. Even here, Regional Print fared better than their National counterparts, experiencing a less dramatic fall in both circulation numbers and advertising revenues, as well as a quicker bounce back.

All told, the digital wave is still undeniable. With one of the world's largest internet user bases, India has seen a surge in online news platforms, digital streaming services and social media usage. The younger demographic in particular is driving the shift from traditional to digital. This growing shift to digital and the pandemics impact on the traditional print industry both underscore the need for print media houses to innovate and adapt, blending the strengths of traditional journalism with the reach and immediacy of digital platforms.

Sandesh Financials

A quick discussion on how Sandesh generates revenues and the trends following the pandemics impact. This part is important, as it pertains to the catalysts I discuss later as my reasons for investing.

The company’s financials followed the general industry trends. Revenues from operations peaked in FY19 at 417cr, and subsequently dropped 18.2% in FY20 to 341cr and a further 20.3% in FY21 to 272cr as circulation of newspapers and ad revenues dropped due to COVID restrictions. Since then, revenues have bounced back, growing at a rate of 11.7% annually between FY21 and FY23. Revenues, however, still are 18.7% below their FY19 peak.

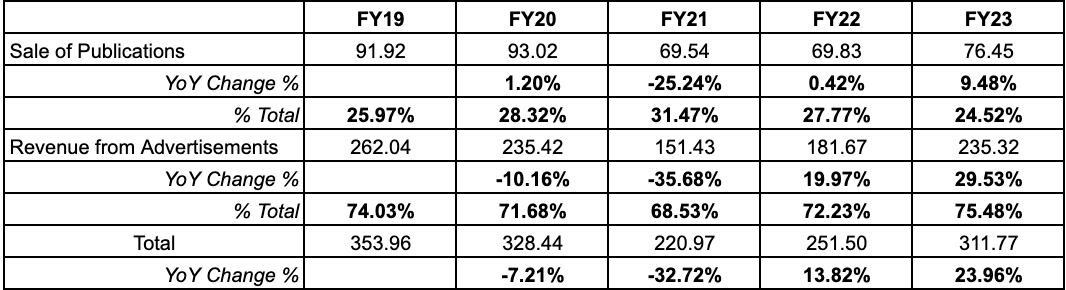

The bulk of the company’s revenues come from 1) The sale of publications, and 2) Revenues from advertisements. Advertising revenues generally accounts for between 70-75% of total revenues, with sale of publications accounting for the remaining 25-30%.

The revenues from sale of publications has been in a general decline. In FY17, the figures were 99cr and by FY20 had declined to 93cr. After a drop of over 25% to 69.5cr in FY21, revenues from this division remained flat in FY22 before rising by 9.5% to 76.5cr in FY23, though still 17.8% below FY20 levels.

Advertising revenues on the other hand experienced growth leading up to FY19, when it peaked at 262cr. These revenues fell by 10% in FY20 and a further 36% in FY21 to 151cr. Since then, revenues from this division bounced back sharply, first by 20% and then another 30% to 235cr - reaching FY20 levels and within 10% of the FY19 peak.

The pandemic’s impact on Sandesh wasn’t all negative. Impacted by falling revenues, the company worked to improve its operating margins. The company grew EBITDA margins that were 20% in FY19 to between 25-28% in FY21-23. As a result, net income actually grew, from 57cr in FY19 to 76cr in FY23. [Note: I don’t include other income as part of revenues in my calculations, so they appear lower than reported figures].

Recent headwinds make this margin improvement even more impressive. The bulk of Sandesh’s expenses comes in the form of newsprint costs. As a result of the pandemic that disrupted the operations of newsprint mills, and the impact of the Ukraine war which affected the import of newsprint (Russia is a major exporter), both international and domestic newsprint rates shot up to as high as $1000 per metric ton by FY22. Despite this dramatic rise in an essential input cost, the company was still able to boost both operating margins and net profitability.

Catalysts

I see two catalysts that could boost earnings and the stock price.