Ambika Cotton Mills (NSE:AMBIKCO)

(Disc. Invested. Not a recommendation.)

Today, I purchased shares of Ambika Cotton at ₹ 1537/share and have added it to the Valuewala Model Portfolio which is now fully invested.

CMP: ₹1534. Market Cap: ₹878.2cr. Enterprise Value: ₹569.2cr.

About the Company

Ambika Cotton Mills Limited (ACML) is a distinguished player in the textile industry, renowned for manufacturing premium quality compact and Eli Twist cotton yarn for hosiery and weaving.

Established in 1988 and based in Coimbatore, India, the company has carved out a niche for itself, primarily due to its commitment to product quality and delivery reliability. The company's product range - particularly its high-quality compact yarn - is a coveted resource for producers of premium woven and knitted fabrics. The company operates through its five manufacturing facilities, offering a collective spindle capacity of over one lakh for compact spinning and knitting.

The Textile Industry: From Seed to Shirt

India's textiles sector is one of the oldest in the Indian economy, contributing over 14% of Industrial Production, and is one of the largest contributors to India's exports.

The textile industry has two broad segments. First, the unorganised sector, consists of handloom, handicrafts and sericulture, which are operated on a small scale and through traditional tools and methods. The second is the organised sector, consisting of spinning, apparel and garments segment which apply modern machinery and techniques such as economies of scale.

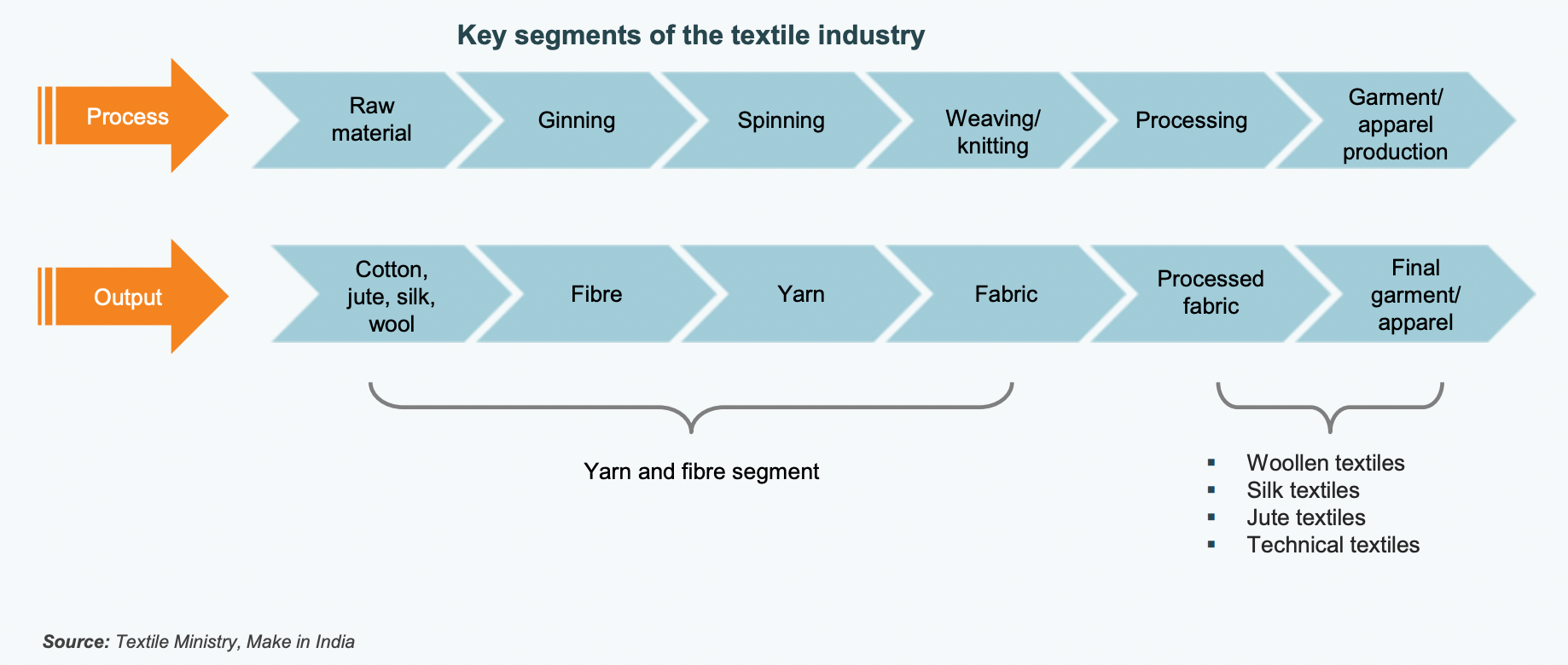

A brief look at the textile value chain from seed to finished garments.

First, cotton plant is cultivated and harvested. Next, the cotton fibre is taken to the cotton gin where the fibre (lint) is separated from the seed (ginning) and is cleaned of any dirt, dust or trash that may have gotten mixed during harvesting. This cleaned and separated raw cotton is then compacted into large bales and sent to spinning mills where it is processed into yarn of various thicknesses (spinning). The yarn is further processed into fabric either through weaving (interacting at right angles) or knitting (looping of yarn). From here, the woven or knitted fabric is dyed to give it colour and may receive other finishing treatment such as bleaching and pre-shrinking that enhance the fabric appearance, durability, feel or performance (processing). The processed fabric is then sent to garment factories, where it is cut and sewn into clothing. Finally, the finished garment is either sold directly to customers or distributed to retailers, who then sell it to customers (retail).

Now that we have an understanding of the textile process, let’s look at ACMLs position in the value chain and dive deeper into its operations.

Summary of Operations

Ambika Cotton maintains a strong supply chain network, sourcing raw cotton from reputed farmers and intermediaries from USA, Egypt and Australia, then uses it for its production activities. It then sells its products to buyers both domestically and internationally.

The company carries strong goodwill among both its suppliers and buyers. It prides itself on honouring the terms of its contract with suppliers without re-negotiating even under adverse conditions such as the pandemic, as well as accepting request from buyers for deferment of deliveries to suit their convenience. Such goodwill goes a long way in establishing and maintain long-term relationships with both suppliers and buyers and can prove advantageous to the company in the future. Its key area of strategic focus is on customer satisfaction and attracting new customers through commitment to production of high quality products, which serves as a strong base in this regard.

One of the company's most notable features is its commitment to sustainable practices. Ambika Cotton Mills produces clean wind power to meet 100% of its power and energy requirements through its installed windmills. This emphasis on sustainability extends to its product certifications, which include the Supima, GOTS (organic yarn), and Standard 100 Product Class I Oeko-Tek Certificates. Such dedication to sustainability aligns with the increasing global emphasis of environmental responsibility, potentially paving the way for expanded market opportunities.

ACML generates its revenues through the sale of:

Cotton Yarn: For most of its history, the company has predominantly operated as a spinning mill, processing cotton bales into high-quality specialty yarn. It’s product range, particularly its high-quality compact and Eli-Twist cotton yarn is a coveted resource for producers of premium woven and knitted fabrics. The company is a distinguished leader in the shirting segment, making it a favoured supplier to top quality shirt manufacturers worldwide. Its impeccable product quality, evident in its ‘100% contamination-free cotton yarn’, and its unwavering commitment to delivery fulfilment, have solidified its position in a unique niche of the textile industry.

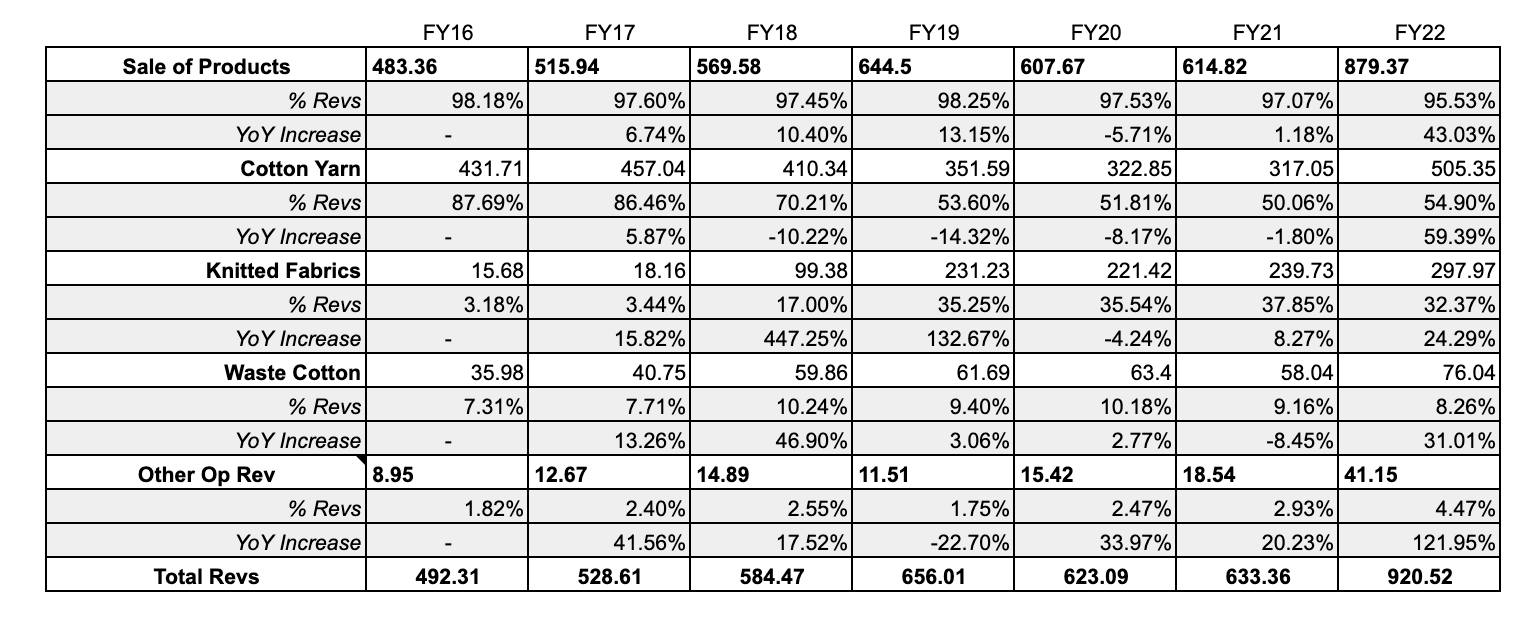

The company has, in recent years, diversified away from being a purely cotton yarn manufacturer, and the divisions share of revenues have dropped from 88% in FY16 to around 55% of revenues since FY19.

Knitted Fabrics: Since 2017, the company has consciously and aggressively grown its knitting efforts, one step up the value chain. The knitting segment now contributes over 30% of revenues, up from just 3% in FY17. For this, the company takes a portion of its cotton yarn production for captive use in its knitting division.

Waste Cotton: ACML also sells waste cotton (leftover cotton fibre used in products such as make-up pads and swabs) that brings in approximately 7-10% of revenues.

Other: Lastly, the company makes a small sum from export benefits, foreign exchange fluctuations, REC (Renewable Energy Certificate) sales, sale of scrap and raw material as well as the sale of excess wind energy it produces from its installed windmills. Together, these activities contribute the remaining 1-4% of revenues.

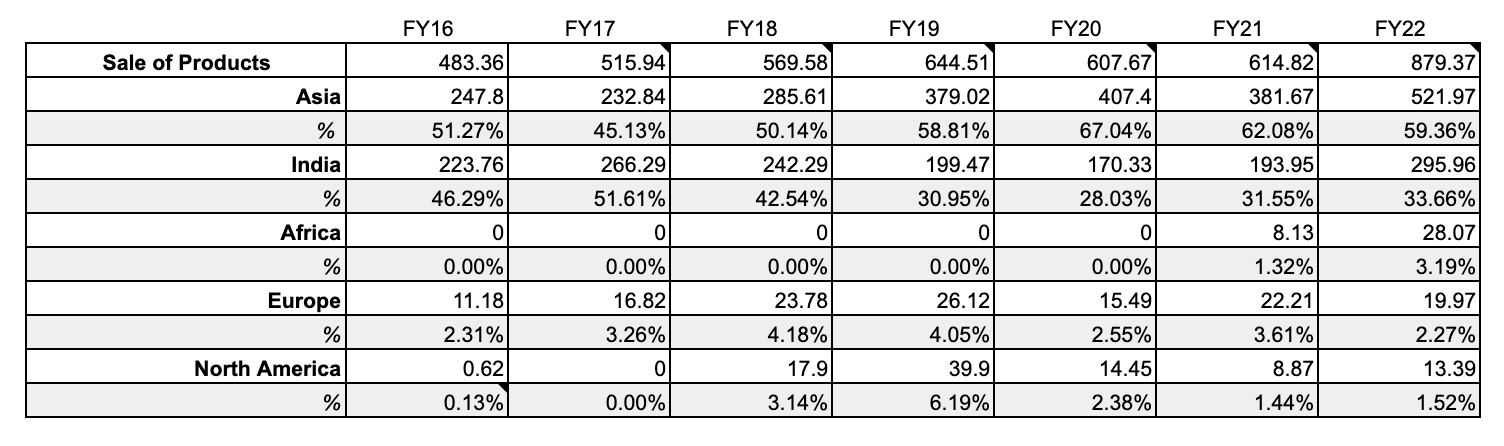

The company has good geographical diversification in addition to its revenue diversification. Its share of exports have grown from 50% of revenues in FY17 to over 60% since FY18 and In FY22, exports contributed around 66% of revenues.

Of the exports, the lions share is to Asian countries (60%+), particularly Japan. Exports to Africa, Europe and the USA together contribute around 5-10% of revenues (FY22 4.8%).

Next, lets determine a value for the company’s stock.

Valuation

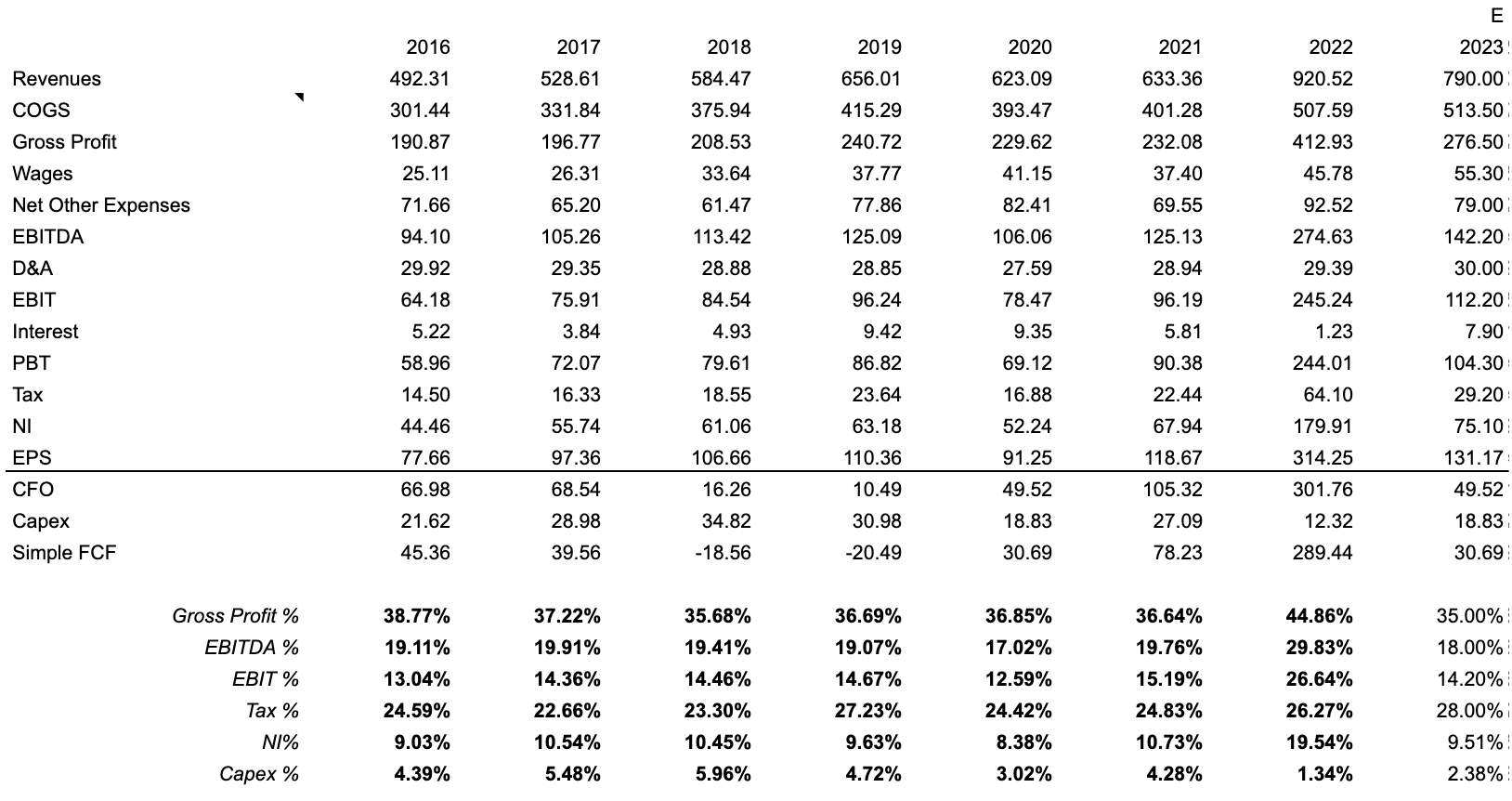

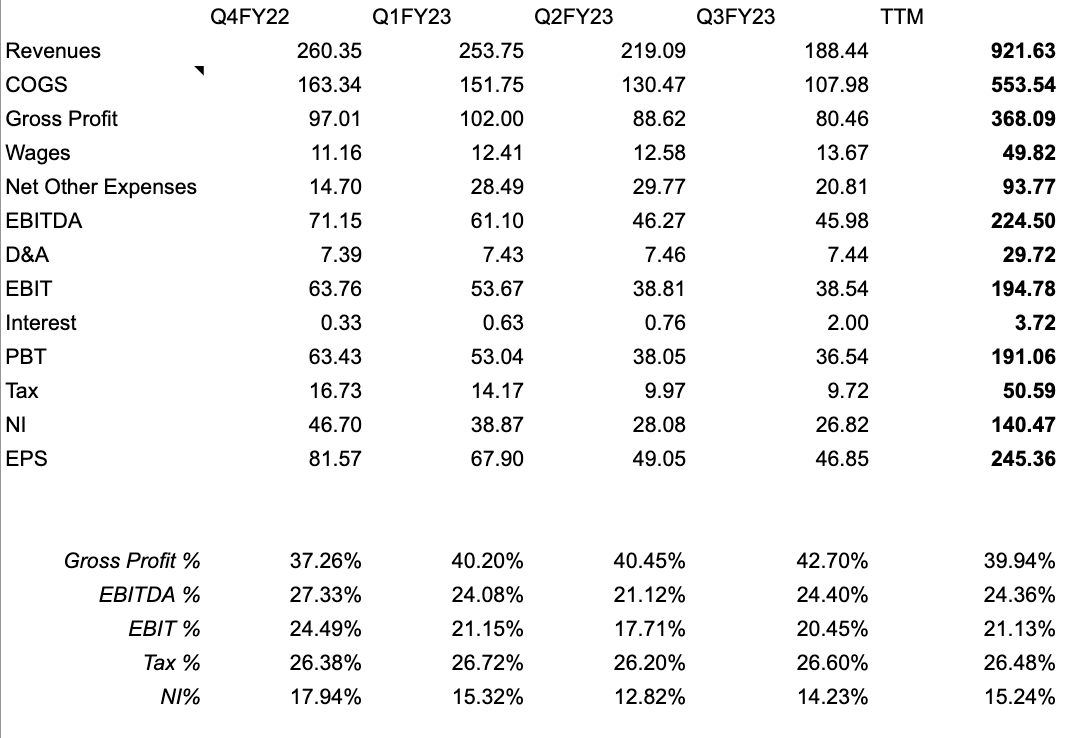

First, a quick look at ACMLs income statement for FY16-22 and TTM. Note that my estimates for 2023 revenue and net income are far less than the TTM figures and so the cash flow projections from revenues that follow will be naturally conservative. For instance, the company need only make 150cr in revenues this quarter (the last time quarter revenues were less than 150cr was in Sep 20).

Also note that the company has an excellent balance sheet with ₹309.3cr in cash and equivalents on its books and carries no debt.

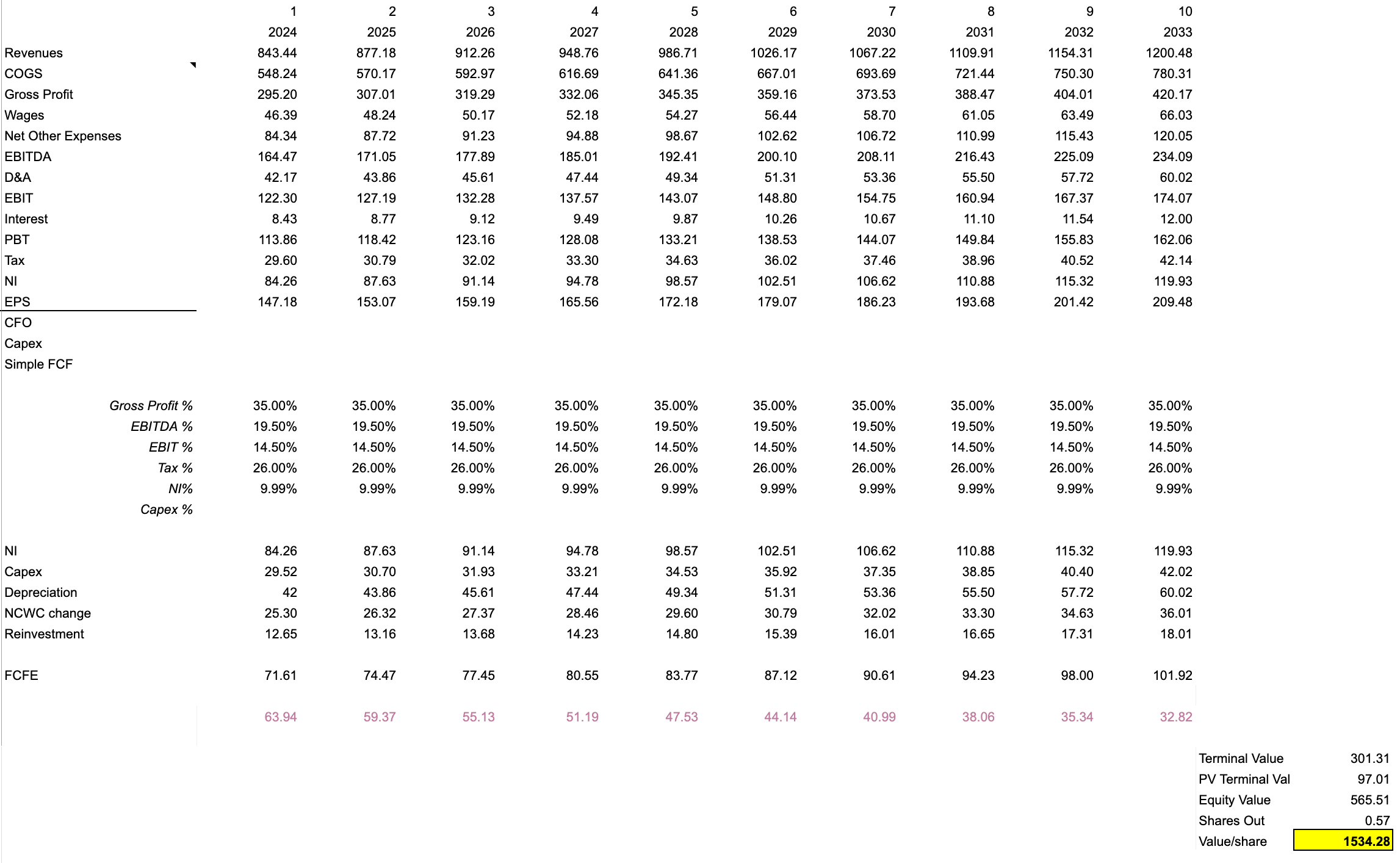

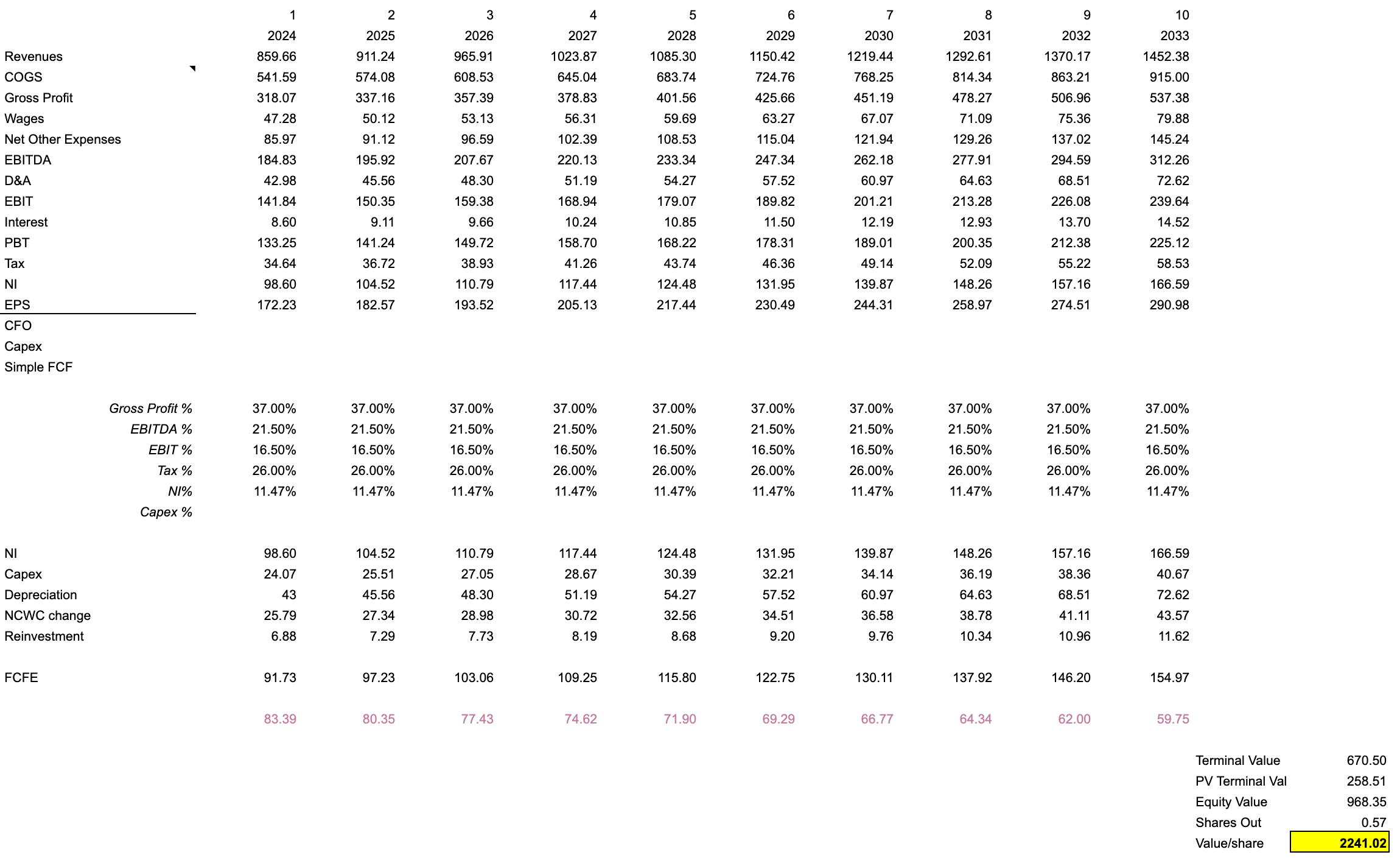

I’ve run two DCF estimates, one conservative and the other as a base.

The major conservative estimate assumptions: revenues will grow 4% each year, COGS will be 65% of revenues, a 26% tax rate and Capex at 3.5% of revenues. I use a 12% discount rate and a 1% terminal growth rate. The resulting value (after adding back the cash balance which isn’t included in cash flow projections) is ₹1534.3/share.

The major base estimate assumptions: revenues will grow 6% each year, COGS will be 63% of revenues, a 26% tax rate and Capex at 2.8% of revenues. I use a 10% discount rate and a 1% terminal growth rate. The resulting value (after adding back the cash balance which isn’t included in cash flow projections) is ₹2241/share. Also, note that even in the base projections, I project that the company will not achieve the kind of profitability it did in FY22.

Blending the two values 50:50, my estimates of fair value come at ₹1887.65/share. At CMP, the stock is currently available at an 18.75% discount to this estimate.

Now, because the company has tons of cash and no debt, one should look at the enterprise value and not the market capitalisation. In other words, though the company has a market capitalisation of ~₹880cr, since it has no debt and ₹309cr in cash, one could effectively acquire the entire company for under ₹570cr. That’s incredibly cheap for a company that in the last FY generated over ₹245cr in EBIT (i.e earnings to owners of capital, before taxes).

Historically, the company has traded at an average EV/EBIT of 6.2 over the last 5 years. The TTM EV/EBIT is just 2.92 (i.e. one would recoup their entire purchase in under 3 years of TTM earnings), which is less than half of the past 5 year average, indicating a potential bargain.

Threats

Though ACML's products enjoy global recognition for their quality and durability and the stock is currently undervalued, the company faces challenges that are inherent to the textile industry. As a capital-intensive industry with volatility and dependence on global economic conditions, it grapples with fluctuating cotton prices, labor costs, and geopolitical tensions that impact export markets. Additionally, the company's niche focus, while providing a unique selling proposition, also exposes it to the risk of changes in demand from its specific customer base.

Though these are very real threats, I believe the company has navigated these challenges particularly well. The company has managed to generate positive free cash flow in 8 of the last 10 years (all years excluding FY17,18) and has low Capex requirements in comparison to its peers. Additionally, it has managed to fund its Capex in recent years entirely through internal accruals. The excess cash and absence of debt will help the company navigate operations in the event of poor economic conditions and/or future supply chain disruptions, as will the goodwill it carries among its buyers and suppliers. Finally, it seems management is proactive and cautious. For instance, prior to FY23, the company had already entered into contracts with suppliers for the import of cotton to ensure availability of adequate cotton for smooth operations. Such pre-emptive measure should give shareholders confidence in managements ability.

Conclusion

Ambika Cotton Mills is an established player in the textile industry, recognised for its premium quality cotton yarn and commitment to sustainability. Despite challenges inherent to the textile sector, it has demonstrated robust financial performance, maintaining a debt-free balance sheet and generating strong free cash flow.

The past year's drop in earnings compared to FY22 gives me an opportunity to buy the stock cheap. My future cash flow assumptions show that even if the stock doesn't ever match the FY22 earnings in the next 10 years, it is still undervalued.

With its stock currently undervalued and a diverse revenue stream that includes both domestic and international markets, ACML represents a potentially attractive investment opportunity. The company's proactive management, solid customer relationships, and strategic operations contribute to its resilience and potential for continued growth in the future.

Member discussion