Sun TV (NSE:SUNTV)

(Disclosure: Invested. Not a recommendation).

CMP: ₹ 440.65/share

In the past month, I added two new stocks to my portfolio but didn't find the time to write about them. One of them was Bhansali Engineering (BEPL) that I bought for ₹ 92/share. It has since run up over 40% so it doesn't make much sense to write about it now. The other is Sun TV, which I bought for an average price of ₹ 407.5/share and believe is trading at an excellent price for long-term investors.

Brief Overview of Company

Sun TV Network Ltd., part of the Sun Group, is one of the largest media conglomerates in the country. The group operates an array of 33 television channels, reaching over 140+ million households in India and spanning regions across the globe, including the U.S.A, Canada, Europe, Singapore, Malaysia, Sri Lanka, South Africa, Australia, and New Zealand.

The Network produces and broadcasts satellite television and radio software programming primarily in the regional languages of South India, including Tamil, Telugu, Kannada and Malayalam. As it continues to expand its footprint, Sun TV Network has also ventured into the Marathi and Bengali language market with two new channels.

Alongside its TV channels, the Sun Group also operates 69 FM Radio Stations, three Daily Newspapers, and six Magazines. Dinakaran, one of its newspapers, is a leading Tamil daily with daily sales of over 1.4 million copies. Sun Direct, the group's Direct To Home (DTH) Satellite TV service, is one of the largest in India, boasting more than 16+ million subscribers. The Network also manages an OTT platform, “SUNNXT”.

Beyond traditional media, It also operates the Indian Premier League (IPL) franchise “Sun Risers Hyderabad” (SRH) in India and Sun Risers Eastern Cape (SREC) in South Africa.

With its 33 Television Channels in 6 languages, large DTH service provider, 69 FM Radio Stations, 3 Daily Newspapers, 6 Magazines, and IPL franchise, SUN TV stands as a true media powerhouse in India and is currently available at attractive valuations.

How does SUNTV make money?

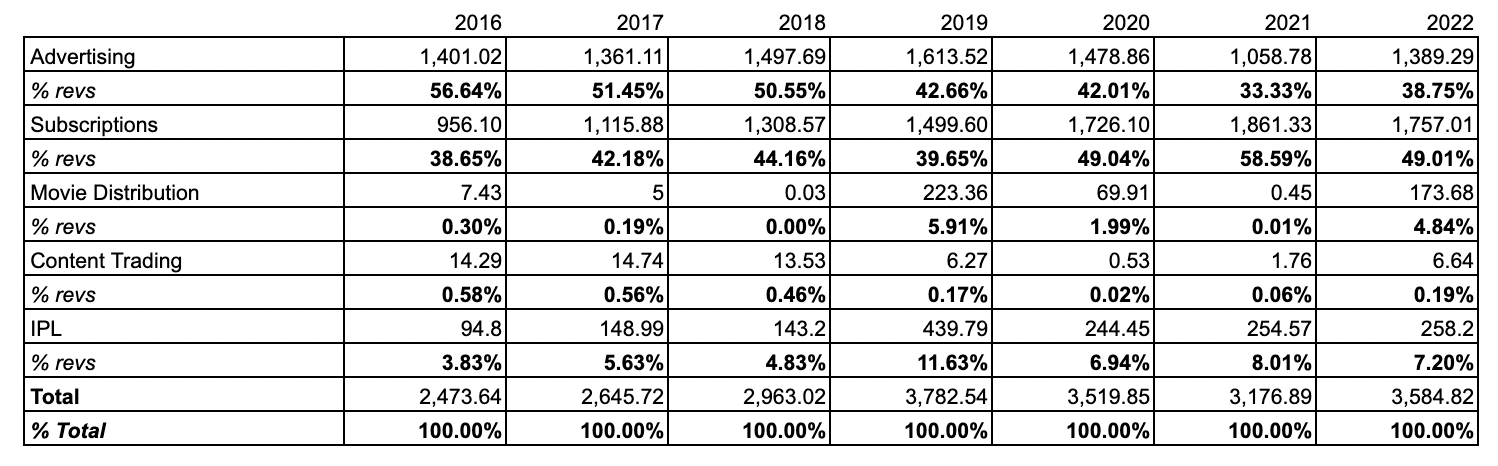

Sun TV makes the bulk of its revenues from advertising and the sale of broadcast slots alongside subscription revenues from its DTH and OTT platform. Together, they account for between 80-95% of revenues each year. The rest of their income comes from movie distribution (which is both highly erratic and volatile), content trading and from the Indian Premier League. Below is a breakdown of their revenues over the last 7 Financial Years (FY16-FY22) and how much each segment contributes to total revenues.

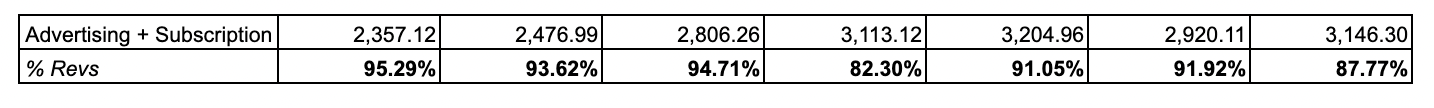

Since both advertising and subscription revenues contribute the bulk of Sun TVs revenues, it might help to view them together. Below is the combined advertising and subscription revenue figures over the same period and their combined contribution to total revenues.

A few trends to note:

- Advertising revenues saw a sharp decline following FY19, dropping from a peak of ₹ 1613cr to as low as ₹ 1058cr in FY21. It rebounded slightly in FY22 to ₹ 1389cr but is still a far shout from the kind of numbers it brought in prior years.

- Subscription revenues had nearly doubled over the last 6 years from ₹ 956cr in FY16 to ₹ 1861cr in FY21, but has since fallen to ₹ 1757cr in FY22.

- Subscription revenues overtook advertising as the lead segment in FY20.

- Movie distribution revenues are volatile, but in certain years (presumably when the group produces box-office hit movies) can contribute a decent amount to revenues. There has been greater contribution to total revenues from this segment since 2019. FY22s figures came off the back of three blockbuster titles features box office icons). For FY23, the box office success Beast starring Vijay, was produced by Sun TV.

- IPL revenues are growing.

- Combined advertising and subscription revenues have trended upwards, though they saw a minor decline in FY21 and have since rebounded.

- Combined advertising and subscription revenues’ contribution to total revenues is trending downwards, with greater contributions coming from the movie distribution and IPL segments. Management believes that the coming years will see a ‘substantial rise’ in revenue contribution from their Cricket Franchises (SRH and SREC) as well as incremental revenues from their DTH and movie distribution segments.

Some management quotes from the FY22 annual report that might be relevant here (I have bolded for added emphasis):

- “In the recent years, subscription revenues have overtaken advertisement revenues, however as mentioned herein with increased viewership, the bandwidth to widen the advertisement revenue base remains very strong. With the continued influence of digitalisation on the Media and Entertainment Industry, the opportunities to enhance the revenue are on the rise.”

- “Sun Network delivers a steady flow of highly popular programs and a dominant share of audience viewership which has given the network tremendous pricing power vis-a-vis competitors.”

- “In the coming years it is expected that the contribution of revenues from the Cricket Franchise will rise substantially further supported by incremental revenues from movie distribution.

- “It is expected that the new stream of revenue for the Company arising from the increased DTH subscriber base in South India would maintain a positive momentum in the coming years.”

With Sun TVs revenue sources out of the way, lets consider whether the company truly has a moat.

What’s SUN TVs moat?

Unless you’re entirely new to the world of investing, you’ve probably heard about company moats. Simply put, a moat (in investing terms), as popularised by Warren Buffett and Charlie Munger, is a sustainable competitive advantage that a business possesses, which protects it against competitors. Moats make a company difficult to compete with and often lead to long-term profitability and market leadership.

Without wasting too much time here, I’ll summarise why I believe Sun TV has a moat, and a strong one at that:

- A strong brand and regional dominance: Sun TV has a dominant foothold in South India, particularly in the Tamil Nadu market and broadcasts content through various channels and in several South Indian languages. Not only does such regional dominance create a barrier to entry for competitors aiming to enter the space, it also grants SUN TV incredible pricing power. Here’s two thought experiments to support my argument:

- If you (or a competitor) had billions of dollars to spend and all the managerial talent in the world, could you (they) replicate Sun TVs dominance in the South Indian regional market that took it over 30 years to build?

- If you wanted to advertise a product/service to the Indian population, how else would you go about reaching the millions of households in the South of India? What other choice do you have but to pay the prices Sun TV demands of you?

2. Content ownership and production: Sun TV creates a significant amount of its own content. Not only does this allow greater control over costs and quality, it also allows the company to generate additional revenue by syndicating its content to other platforms.

3. Diverse media portfolio: Sun TV has a diversified media portfolio consisting of channels in different languages, FM radio stations, newspapers and a DTH and OTT service. Not only does this provide multiple revenue streams and a broad reach across different formats, it also contributes to their pricing power with advertisers. Advertisers can advertise across the types of formats that are to their liking.

All these factors convince me that Sun TV has a strong moat. It should be noted, however, that moats aren’t permanent and a company must continue to reinvest to maintain its moat and stronghold. In the 30 years since its inception, Sun TV has managed to do just that, through new channels, revenue streams, content and acquisitions that have helped both maintain and solidify its brand. I believe Sun TV will continue to do just that and won’t lose its dominance in the regional market.

Financial Overview and Key Ratios

Sun TVs Annual Income Statement (FY10 - TTM)

(I use Wisesheets, an API that helps me plugin financial data into Google Sheets for analysis. While the data is mostly accurate, I have noticed some inconsistencies in the reported figures. Nevertheless, these are minor differences and since I’m more interested in the trends and ratios, they don’t cause much of an issue and are accurate enough for analysis.)

SUN TV TTM Quarterly Income Statements:

I like to view 3 year averages as they smooth out earnings and provide a better idea of the trends.

- 3 year average revenues have grown YoY but dipped slightly in FY22. TTM revenues have been the highest since FY10.

- 3 year average gross profit has grown YoY but again, dipped slightly in FY22. TTM gross profit has rebounded but is still short of the 2019 figures.

- 3 year average operating income, net income and EPS have grown YoY and the FY22 figures (single year) were the highest in the company’s history (61.3% and 45.8% margins, respectively). The TTM figures are even higher.

SUN TV Key Ratios:

To better understand the above table, I’m trying to figure out what price would bring the company’s stock in line with its 3 year average. Keep in mind that the 3 year average ratio includes the very low figures from FY20. For instance, the 3 year average PE is 10.68, but the 5 year average shoots up to 15.84.

Reproduced below is the single year ratios for the above FY16 onwards.

Let’s see the price with a 5-year average perspective.

A huge difference between the 3 year average and 5 year average figures.

The company currently trades at historically low ratios relative to its own past and at levels close to those seen in FY20. From the 3 year and 5 year average multiples, we can infer that the company has an upside somewhere between those figures and ranges.

Valuation

While the relative valuation above gives us an idea of where the stocks price can go, a Free Cash Flow analysis will help us determine the right price to pay for the stock.

I disregard the TTM figures and project out conservatively from FY22 figures. My assumptions are simple and I try not to complicate the analysis too much. All I’m trying to achieve is a ballpark estimate, nothing fancy.

My major assumptions are as follows:

- Revenues will grow at 6% annually.

- COGS at 16% of revenues.

- D&A at 18% of revenues.

- Tax Rate 30%.

- Discount Rate 10%.

- Terminal Growth Rate 2%.

Here’s how the above figures compare to their actual figures from 2016-2022

The resulting value of 393.76/share is conservatively estimated. For instance, my 2023 estimates of EPS come to just 37.76/share with these assumptions, whereas the TTM EPS is 43.37/share. To match, this quarters EPS has to come at just 4.65/share (the stock has averaged over 10/share in the last 4 quarters.)

At the CMP of 440.65/share, the stock currently trades roughly 11% off my estimates of fair value. While I usually only like to buy stocks when they are available at a discount to my conservatively estimated value, I am willing to make an exception if I believe I am buying a quality company with stable and growing revenues and a moat (competitive advantage). Sun TV represents such a company.

Conclusion

In conclusion, Sun TV Network stands as an undisputed leader in the Indian media landscape, thanks to its strong regional dominance, wide array of media offerings, and expansive global reach. The company's resilient business model, which blends traditional media with digital platforms, ensures a steady stream of revenue from a diverse set of sources.

The company’s ability to consistently generate revenue, even amidst fluctuating market dynamics, is a testament to its strong moat. This moat, characterized by its regional stronghold, content ownership, and multi-format approach, is key to Sun TV's competitive advantage.

Despite the challenges faced in the advertising segment, the company has demonstrated resilience and adaptability, with a promising growth trajectory in subscription revenues, movie distribution, and IPL revenues. Sun TV's management also shows confidence in further enhancing revenue streams through digitisation and growing the DTH subscriber base, indicating a promising future.

Sun TVs financial performance over the past decade has been impressive, showcasing consistent growth in revenues, gross profit, and operating income. Its low valuation ratios, compared to historical averages, suggest potential for upside in the stock price.

The analysis of Sun TV's valuation, taking into account the conservative assumptions and relative valuation methods, indicates that the company's stock offers a compelling investment opportunity. Despite trading slightly above the estimated fair value, the company's strong fundamentals and growth prospects make it an attractive proposition.

If you've read this far, thankyou. If you enjoyed the work I put out, please consider subscribing. You will get updates on new posts to your email and you can read it straight from there. You can expect 1-2 stock analyses each month.

Member discussion